Your Take-Home Pay May Increase Under New 2023 Tax Rules

By: Stacey Nickens

With inflation on the rise, the IRS has expanded tax brackets, increased certain credits, and raised the standard deduction for the 2023 tax year. These changes could decrease many Americans’ tax burdens by allowing more taxpayers to remain in lower income tax brackets.

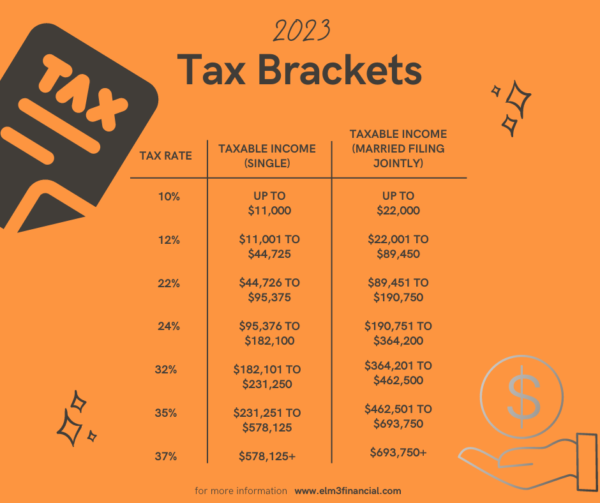

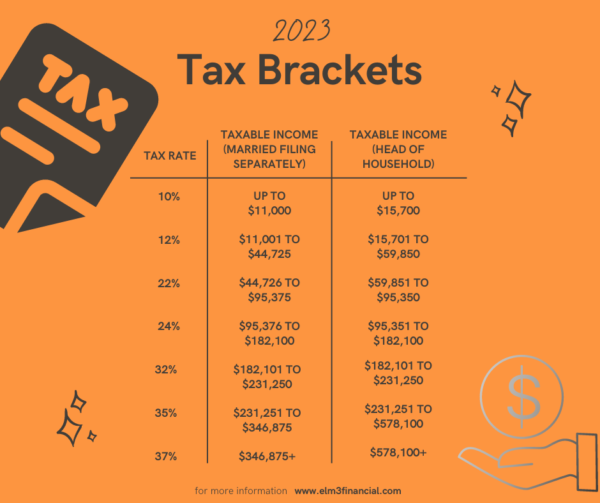

As you can see in the accompanying charts, the highest 37% tax rate will now apply to single filers with income above $578,125 and for married filing jointly filers with income above $693,750. The IRS increased these top thresholds by 7% from 2022 in accordance with rising inflation.

How might the expansion of tax brackets impact you?

Taxpayers who were close to the edge of a tax bracket in 2022 may find themselves securely in the lower tax bracket in 2023. Taxpayers may even find themselves bumped down a bracket. With these changes, taxpayers may see an increase in their net income in 2023.

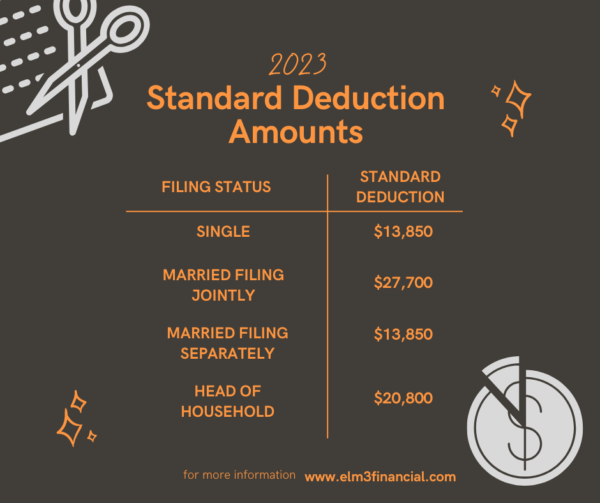

Standard deduction amounts have also increased significantly for the 2023 tax year, the largest adjustment since 1985. The increase to the standard deduction could mean fewer taxpayers itemize their deductions for the 2023 tax year.

Inflation additionally impacted credits and exclusions for the 2023 tax year. The earned income credit will be increasing to $7,430. The annual gift tax exclusion will jump to $17,000, and the estate tax threshold will rise to $12.9 million. Finally, the adoption credit will increase to $15,950 per child.

If you face a lower tax rate or bill in 2023, you could consider…

- Selling appreciated securities and paying capital gains tax. Doing so could allow you to minimize capital gains taxation during higher tax rate years.

- Completing a Roth conversion, taking advantage of a lower tax rate to set aside after-tax savings.

- Exercising non-qualified stock options (NSOs). When NSOs are exercised, you face ordinary income tax on the difference between the strike price (the price when granted) and the stock price at exercise. Bringing in this income during a lower tax year could be beneficial.

Increasing your savings rate.

Increasing your savings rate.- Giving back to your community. Reinvesting savings in your community could assist other folks in managing the higher cost of living. You could also be investing in community programs that may one day benefit you or a loved one.

If you have any questions about changes to the tax code for the 2023 tax year, please do not hesitate to reach out to our qualified tax team. We are always ready and able to assist clients in managing their tax burden.