Your Tax Fact Sheet for the 2020 and 2021 Tax Years

By: Stacey Nickens

As we head into tax season, I wanted to make you aware of some tax code changes and tax facts. Many of these changes are small and only impact income or contribution limits. In the first section, I will review general tax code changes for the 2020 and 2021 tax years. In the second section, I will review some tax facts for the 2020 and 2021 tax years that directly impact investors. You can use these tax facts to start planning for your 2020 and 2021 tax bills. You can also use these tax facts to see if you want to make any additional IRA or HSA contributions prior to April 15, 2021. You have until April 15 to contribute to your IRA or HSA for the 2020 tax year.

Important Tax Facts for All Taxpayers

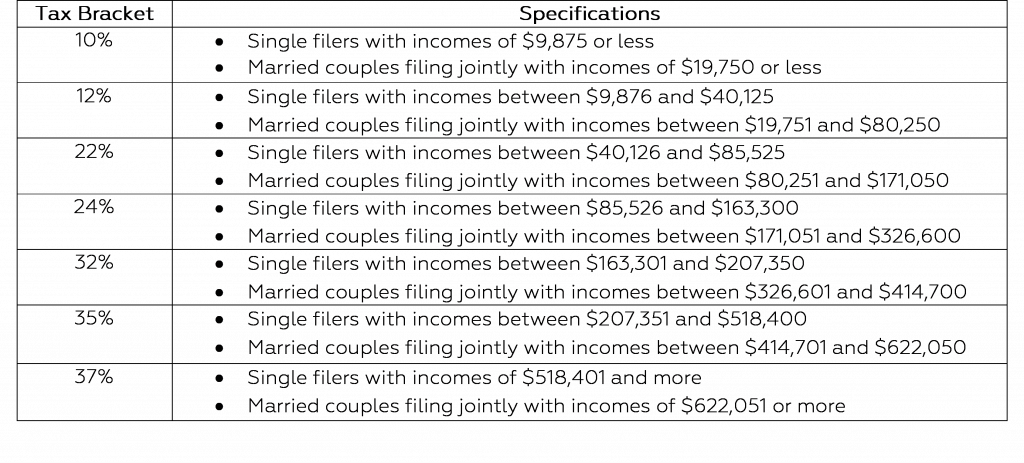

2020 Income Tax Brackets

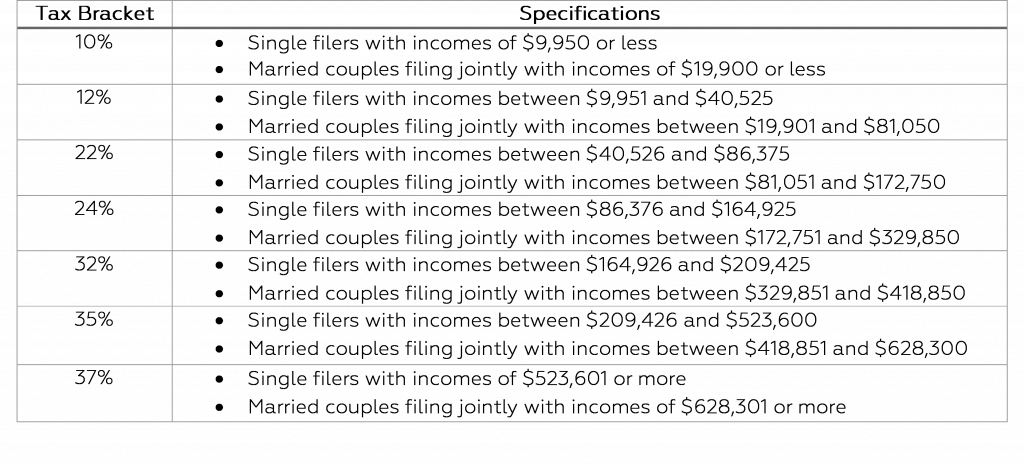

2021 Income Tax Brackets

There are still seven income tax brackets, but the specifications of each bracket have changed.

2020 Standard Deduction

- $12,400 for individuals

- $24,800 for married couples filing jointly

2021 Standard Deduction:

- $12,550 for individuals

- $25,100 for married couples filing jointly

2020 Alternative Minimum Tax:

- $72,900 for individuals

- $113,400 for married couples filing jointly

2021 Alternative Minimum Tax:

- $73,600 for individuals

- $114,600 for married couples filing jointly

2020 Estate Gift Tax Exemption: Each individual’s lifetime gift tax exemption is $11.58 million. You can accordingly gift up to $11.58 million in your lifetime without triggering the gift tax. Each year, an individual can gift up to $15,000 and then file for a gift-tax exclusion. This means that individuals can gift up to $15,000 each year without these gifts counting towards their lifetime gift tax exemption.

2021 Estate Gift Tax Exemption: Each individual’s lifetime gift tax exemption is increasing to $11.7 million. Each individual’s annual gift-tax exclusion amount remains at $15,000.

Kiddie Tax: For tax years 2020 and 2021, the exemption from the kiddie tax will be $2,200. A parent can choose to include a child’s income on the parent’s return if the child’s income is more than $1,100 and less than $11,000.

2020 and 2021 Limits for Deductible Medical Expenses: You can deduct qualifying medical expenses that exceed 7.5% of your adjusted gross income.

Important Tax Facts for Investors

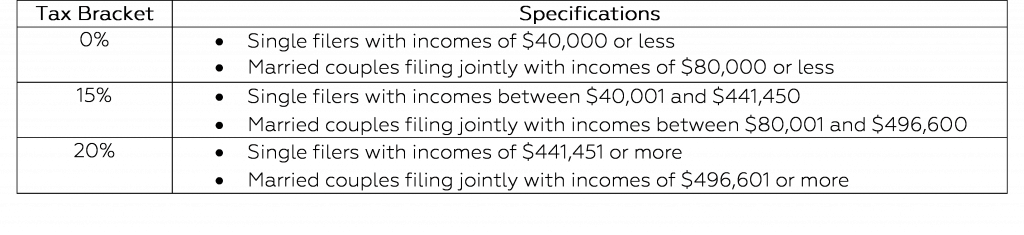

2020 Qualified Dividend and Long-Term Capital Gains Rates: These are the rates at which qualified dividends and long-term capital gains will be taxed. Short-term capital gains on investments held for less than a year are taxed as ordinary income.

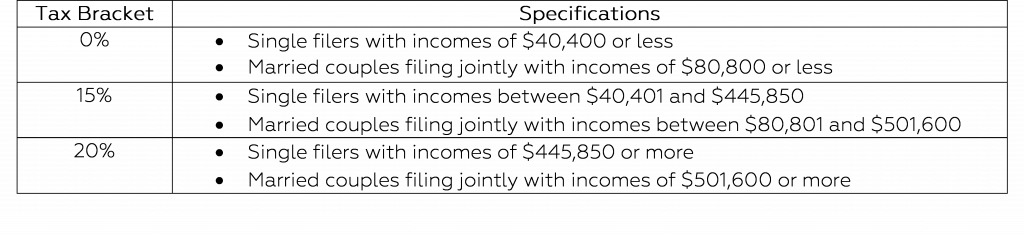

2021 Qualified Dividend and Long-Term Capital Gains Rates

2020 and 2021 Medicare Surtax: An additional 3.8% Medicare surtax will apply to the lesser of…

- Net investment income or

- The excess of modified adjusted gross income over $200,000 for single filers and $250,000 for married couples filing jointly

2020 and 2021 IRA Contribution Limits:

- Under age 50: $6,000

- Over age 50: $7,000

2020 and 2021 Income limits for deductible IRA contributions, if the filers aren’t covered by a retirement plan at work: The contribution is fully deductible.

2020 Income limits for deductible IRA contributions, for single filers who’re covered by a retirement plan at work:

- Fully deductible contribution: Income of $65,000 or less

- Partially deductible contribution: Income between $65,000 and $75,000

- Contribution not deductible: Income of $75,000 or more

2021 Income limits for deductible IRA contributions, for single filers who’re covered by a retirement plan at work:

- Fully deductible contribution: Income of $66,000 or less

- Partially deductible contribution: Income between $66,000 and $76,000

- Contribution not deductible: Income of $76,000 or more

2020 Income limits for deductible IRA contributions, for joint filers where the spouse making the contribution is covered by a retirement plan at work:

- Fully deductible contribution: Income of $104,000 or less

- Partially deductible contribution: Income between $104,000 and $124,000

- Contribution not deductible: Income of $124,000 or more

2021 Income limits for deductible IRA contributions, for joint filers where the spouse making the contribution is covered by a retirement plan at work:

- Fully deductible contribution: Income of $105,000 or less

- Partially deductible contribution: Income between $105,000 and $125,000

- Contribution not deductible: Income of $125,000 or more

2020 Income limits for deductible IRA contributions, for joint filers where the spouse making the contribution isn’t covered by a retirement plan at work but the other spouse is:

- Fully deductible contribution: Income of $196,000 or less

- Partially deductible contribution: Income between $196,000 and $206,000

- Contribution not deductible: Income of $206,000 or less

2021 Income limits for deductible IRA contributions, for joint filers where the spouse making the contribution isn’t covered by a retirement plan at work but the other spouse is:

- Fully deductible contribution: Income of $198,000 or less

- Partially deductible contribution: Income between $198,000 and $208,000

- Contribution not deductible: Income of $208,000 or less

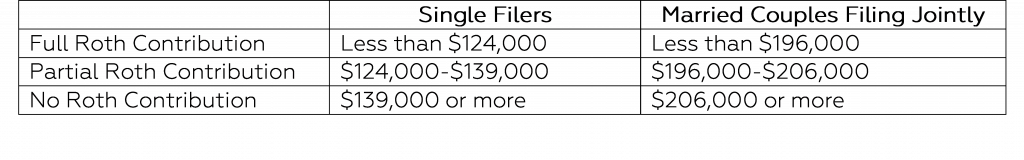

2020 Income limits for Roth IRA Contributions

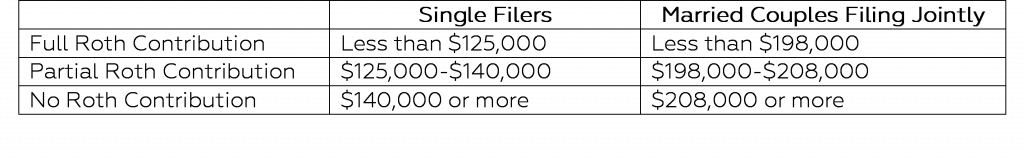

2021 Income limits for Roth IRA Contributions

Qualifying for a Health Savings Account

In order to contribute to a Health Savings Account, the owner must be covered by a High Deductible Health Plan (HDHP). In 2020 and 2021, a qualifying HDHP must have a deductible of at least $1,400 for an individual or $2,800 for a family. In 2020, out-of-pocket expenses cannot exceed $6,900 for an individual or $13,800 for a family. In 2021, out-of-pocket expenses cannot exceed $7,000 for an individual or $14,000 for a family.

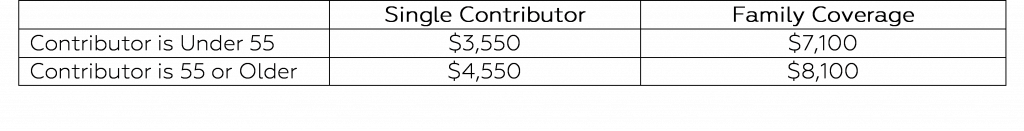

2020 Health Savings Account Contribution Limits

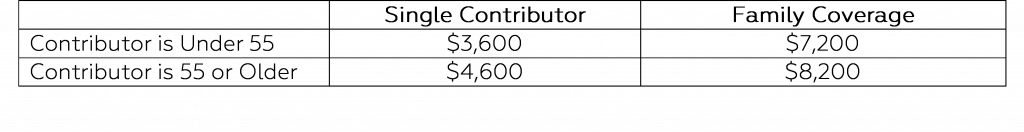

2021 Health Savings Account Contribution Limits

Sources: Morningstar, IRS.gov, NerdWallet