As a small business owner, filing your taxes can be overwhelming, but understanding what deductions you can take on Schedule C (Form 1040) can significantly reduce your taxable income. The IRS allows you to deduct “ordinary and necessary” expenses related to running your business. Here’s a breakdown of common deductions and what materials you should bring to your tax preparer to ensure a smooth filing process.

Common Schedule C Deductions

-

- Home Office Deduction

- If you use a part of your home exclusively for business, you can deduct a portion of rent/mortgage, utilities, and insurance.

- Standard deduction: $5 per square foot (up to 300 sq. ft.), or

- Actual expenses: Based on the percentage of your home used for business.

- Office Supplies & Equipment

- Pens, paper, printer ink, software, and computers used for business.

- Business Use of Your Car

- Standard mileage rate: 67 cents per mile (2024) or 70 cents per mile (2025).

- Or actual expenses (gas, insurance, maintenance) based on business-use percentage.

- Rent & Utilities

- If you rent office space, the full cost is deductible.

- Utilities such as electricity, water, and internet (for business use).

- Employee Wages & Independent Contractors

- Salaries, wages, and payroll taxes for employees.

- Payments to freelancers (must issue Form 1099-NEC if over $600).

- Advertising & Marketing

- Website hosting, online ads, business cards, social media promotions, etc.

- Travel & Meals

- Business-related airfare, hotels, car rentals, and taxis.

- Meals: 50% deductible if for business purposes (keep receipts).

- Professional Services & Fees

- Legal, accounting, and consultant fees.

- Education & Training

- Courses, certifications, and industry-related seminars.

- Insurance

- Business liability, property insurance, and health insurance (for self-employed individuals).

- Depreciation

- Deduction for expensive business assets (vehicles, equipment, furniture).

- Section 179 deduction allows immediate expense of certain assets instead of depreciating over time.

- Retirement Contributions

- SEP IRA, SIMPLE IRA, or solo 401(k) contributions can be deducted.

- Home Office Deduction

What to Bring to Your Tax Preparer

To ensure accuracy and maximize deductions, gather the following documents:

✔ Income Records: 1099-NEC forms, invoices, PayPal/Stripe reports, or bank statements showing business deposits.

✔ Expense Receipts & Statements: Credit card statements, receipts, invoices for deductible expenses. It can be helpful to create a spreadsheet, detailing your total deductible expenses in the above categories from throughout the year.

✔ Mileage Log: Record of business-related miles driven. You will also need your odometer reading at the beginning and end of the year.

✔ Home Office Information: Square footage of home and home office, utility bills, and rent/mortgage details. It is also helpful to record how many hours during which you used your home office throughout the year.

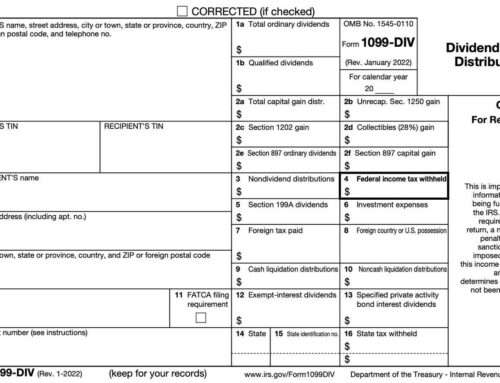

✔ Payroll & Contractor Payments: W-2s for employees, 1099s for independent contractors.

✔ Business Loan & Interest Statements: Records of any business loans and interest paid.

✔ Prior-Year Tax Return: Helps in comparing deductions and identifying carryovers.

✔ Any IRS Correspondence: If you received letters from the IRS, bring them along.

By keeping organized records and understanding your eligible deductions, you can lower your tax bill and keep more of your hard-earned money. Working with a tax professional can help ensure compliance while maximizing savings. Contact us today if you are looking for professional tax preparation or advising services.