Tax documents are likely hitting your mailboxes and inboxes, and as you receive W-2s, 1099s, and other documents, you may be tucking them away for your tax preparer. Even if you do your own taxes, many programs allow you to upload your documents, and the program will review and input information for you, without you ever having to review that document. In either of these scenarios, you are likely not spending much time reviewing your own tax documents.

However, your Form 1099-DIV, Form 1099-INT, and Form 1099-B could give you important information about your investments. These forms detail your dividend income, interest income, and capital gains and losses, respectively. Reviewing these forms can help you improve tax efficiency and maximize income in your accounts. With that in mind, I encourage you to take a few minutes to review your 1099s and consider the following questions.

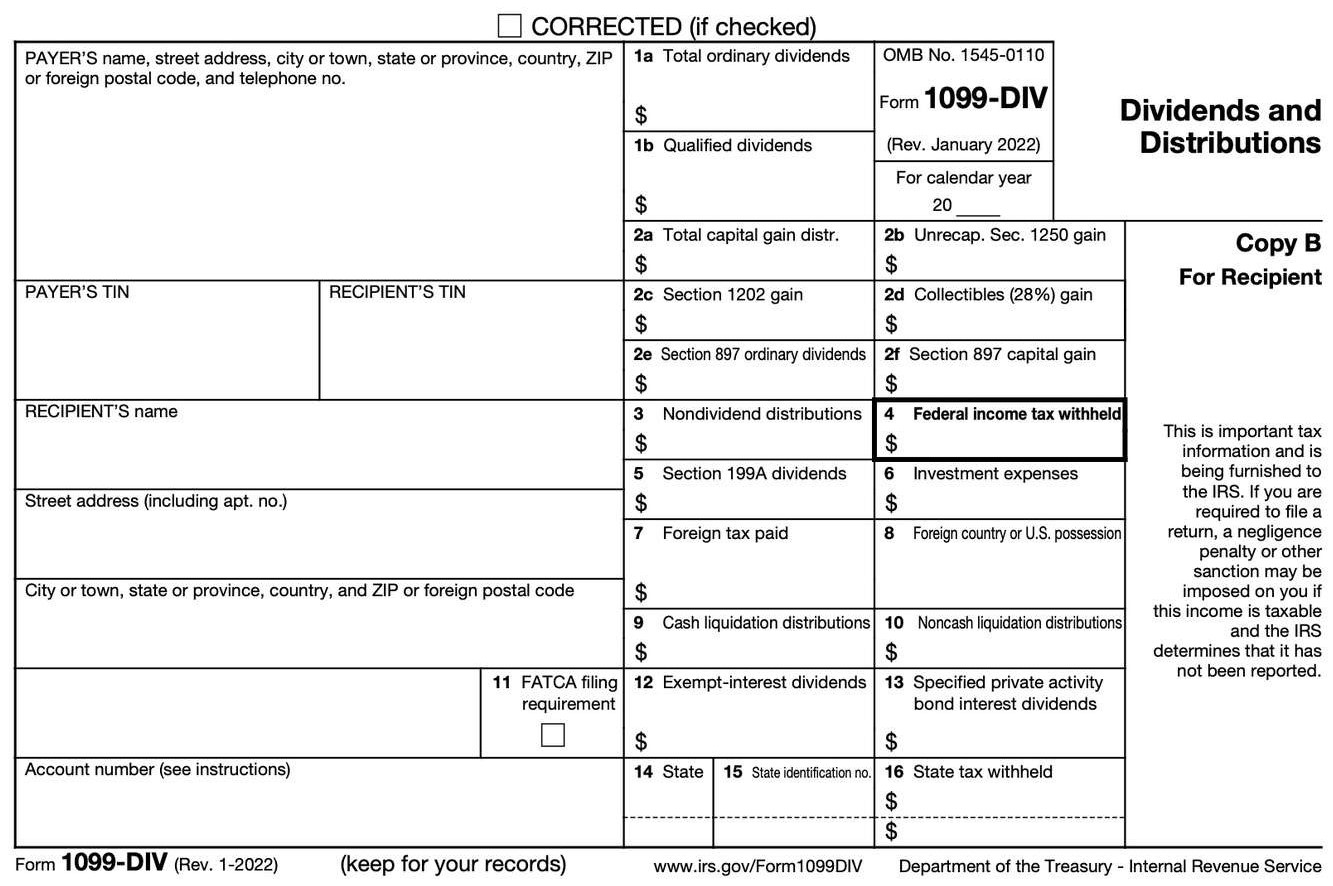

1. How can you maximize the tax efficiency of your dividend income? You will notice two different dividend streams reported on your 1099-DIV: your total ordinary dividends (Box 1a) and your qualified dividends (Box 1b). Qualified dividends are a portion of your total ordinary dividends that are taxed at a lower income tax rate than are nonqualified dividends. Dividends from most U.S. companies, as well as qualified foreign companies, are treated as qualified dividends if a holding-period requirement is meant. Dividends from real estate investment trusts (REITs) and certain foreign companies are treated as non-qualified dividends.

Even though their dividends are taxed at a higher rate, there are benefits to holding REITs and non-qualified foreign stocks. These securities offer diversification benefits, and REITs often feature hefty dividend yields that can benefit an income portfolio. However, if your total ordinary dividend stream (Box 1a) is significantly higher than your qualified dividend stream (Box 1b), you might consider reviewing the dividend earners in your account to improve tax efficiency.

2. Have you considered tax loss harvesting or other strategies to minimize capital gain taxation? Capital gains from mutual funds are reported on 1099-DIV, Box 2a. Capital gains from the sale of other equities are reported on 1099-B. First review your capital gains distributions from your mutual fund holdings. How large are your capital gains distributions for this year? Consider reviewing your 1099-DIVs from previous years to compare. If you are in or close to retirement, you might check for large discrepancies between capital gains distributions each year. If your capital gains from mutual funds are significantly fluctuating year-to-year, it can be hard to plan your retirement income strategy. This may be a sign to reduce some of your mutual fund allocation and increase your dividend-paying stock or ETF allocation. Stock and ETF dividends tend to be much more predictable and regular than capital gains distributions from mutual funds. This could also be beneficial tax strategy, even if you aren’t close to retirement, to create more tax predictability and efficiency.

If you are noticing significant capital gains on your 1099-B, this may be an opportunity to consider tax loss harvesting for the 2023 tax year. Tax loss harvesting involves selling securities at a loss to offset taxation from securities sold at a gain. You might also look at your income trajectory, maximizing capital losses in high income years and maximizing capital gains in lower income years.

3. Are you maximizing your tax-free portfolio income? Review your tax-exempt interest dividends in Box 12 of your Form 1099-DIV. This box reports tax-exempt portfolio income, such as municipal bond interest. Those in a higher tax bracket may want to consider increasing tax-exempt portfolio income to reduce their tax bill.

4. How are you managing foreign taxes in your portfolio? Dividends from foreign securities are taxed both in the company’s country of domicile and in the United States. U.S. taxpayers get a reprieve from this double taxation by claiming a deduction or credit for foreign taxes paid. Your 1099-DIV shows foreign taxes paid in Box 7. Taxpayers can learn two lessons from this. For one, it is usually more beneficial to hold foreign securities in taxable accounts (compared to tax-deferred accounts) so they can claim the deduction or credit for foreign taxes paid. Additionally, taxpayers should weigh their deduction or credit for foreign taxes paid against the amount of taxes they are paying on any nonqualified dividends from that foreign company. If the taxes on nonqualified dividends are outweighing the tax benefit from foreign taxes paid, the foreign company may not be the most tax-efficient investment.

5. Can you consolidate accounts? If you are receiving 1099s from many accounts, you might want to consider consolidating accounts. Consolidating accounts can help you better manage your portfolio, reduce fees, and increase ease in your estate planning.

If you have any questions about your 1099s for 2022, please do not hesitate to reach out to our experienced team. We are happy to assist in better understanding your portfolio, increasing tax efficiency, consolidating accounts, and completing other helpful portfolio management steps.