Elm3’s Guide to the 2021 Child Tax Credit

By: Stacey Nickens

The Child Tax Credit both increased in 2021 and was delivered in a different manner. Unless you unenrolled from advanced payments, parents received monthly payments of their Child Tax Credit. In total, these advanced payments should equal half of the total credit that you are owed. For example, if you qualified for the full $3,600 credit for families with children under 6, you should have received $1,800 in advanced payments.

In order to avoid tax refund delays, it is important that you accurately account for your advanced child tax credit payments. To do so, you should…

- Save Letter 6419: The IRS will be sending eligible parents Letter 6419. This letter will detail the amount you received in Advanced Child Tax Credit payments as well as how your payments were calculated. You can also download this letter from your IRS portal.

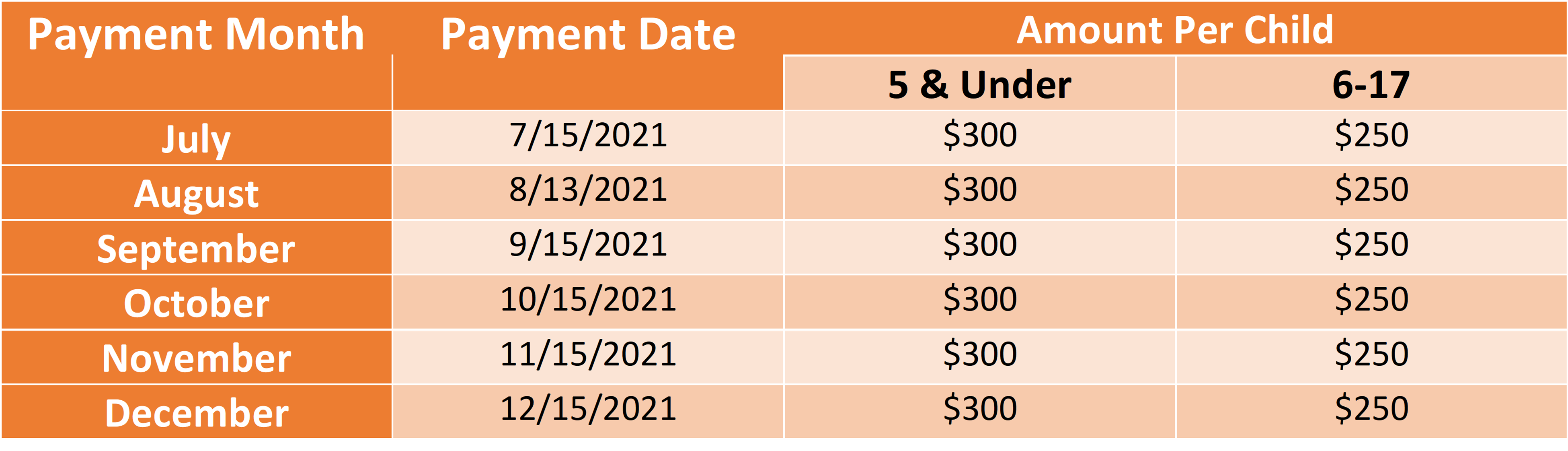

- Review Your Bank Statements: In the table below, you will find the dates on which you should have received Child Tax Credit payments. Download your bank statements from these dates to confirm the amount you received from the IRS on those dates.

Why were my payments less than $250 or $300?

In 2021, the maximum Child Tax Credit for children under 6 was $3,600. The maximum credit for children between the ages of 6 and 17 was $3,000. However, if your 2021 income was above certain thresholds, your credit will be smaller. Your credit is reduced by $50 for every $1,000 you earn over the following thresholds:

- Married Filing Jointly or Qualifying Widower: $150,000

- Head of Household: $112,500

- Single: $75,000

Your credit will not be reduced below $2,000 until your income exceeds the following thresholds:

- Married Filing Jointly: $400,000

- Other: $200,000

I think I qualified for the Child Tax Credit. Why didn’t I receive advanced payments?

To received advanced Child Tax Credit payments, you needed to…

- Claim the Child Tax Credit on your 2019 or 2020 return; OR

- Provide the IRS with your income and family information in 2020 using the Non-Filers: Enter Payment Info Here tool

- Provide the IRS with your income and family information in 2021 using the Non-Filers: Submit Your Information tool

You also needed to…

- Live in a main residence in the United States for more than 6 months during 2021 or file a joint return with a spouse who had a main residence in the United States for more than 6 months during 2021.

- Have a child under the age of 18 at the end of 2021.

- Earn less than the above income thresholds.

I didn’t receive enough or I received too much in advanced Child Tax Credit Payments?

When you file your 2021 return, you will calculate the amount you were owed in Child Tax Credit payments. You will then compare the amount owed against the amount you received. Any additional credit owed to you can be applied on your 2021 return.

If you received more credit than you were owed, you may need to repay the excess. However, you will not need to repay the excess if you lived in a main home in the United States for more than half of 2021 and your income was at or below the following thresholds:

- Married Filing Jointly or Qualifying Widower: $60,000

- Head of Household: $50,000

- Single: $40,000

I have additional questions.

Please reach out to the qualified Elm3 tax team. We are happy to assist you in filing your 2021 return and claiming your 2021 Child Tax Credit.